SCRIBNER, NE — Regulations and information are constantly changing regarding the Small Business Loan application and approval under the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

The City of Scribner and the city’s Economic Development Director, Elizabeth Valla, are working quickly and efficiently with area businesses, so we can all take advantage of this $10,000 emergency cash loan.

To explain it as simple as possible:

• Make an appointment to come in with Elizabeth Valla (402-664-3101, EconDev@scribner-ne.gov) to help fill it out. No initial forms or tax information is needed as originally thought — it changed as of this morning (March 31, 2020).

• Or you can fill it out online yourself…CLICK HERE It should take about 10 minutes (this time has also changed as of this morning).

• From the time of approval it should take about a week to receive the $10,000 in your bank account.

• Payments are deferred up to six to 12 months

• The interest will be 3.75% for businesses and 2.75% for nonprofits, and it will not accrue while you’re not making a payment during this time

• The loan term is up to 10 years

• No personal guarantee or collateral is required for this loan

• If you can later prove that all the funds were used toward your business only, it can be forgiven and will not be considered as income — such as paying building rent/mortgage, paying employees, paying off credit cards that were used for business expenses, etc.

• If you are someone who runs a business out of their home (such as an Etsy shop, making T-shirts or a cleaning business, etc.) You are also eligible for this loan.

• This is an Emergency Cash Loan – it is to be used to help keep your operations running smoothly even though you’ve lost business due to COVID-19. Let me, Elizabeth Valla, reiterate by saying, this is not a “jackpot” it will be owed back in time if you cannot prove that it was used toward your business expenses.

• For businesses in town, the most in-depth info you will need in order to fill this out is: your Employer Identification Number (or social security number); gross income from Jan 1, 2019-Jan 31, 2020; the cost of goods sold from Jan 1, 2019-Jan 31, 2020; and when your business was established.

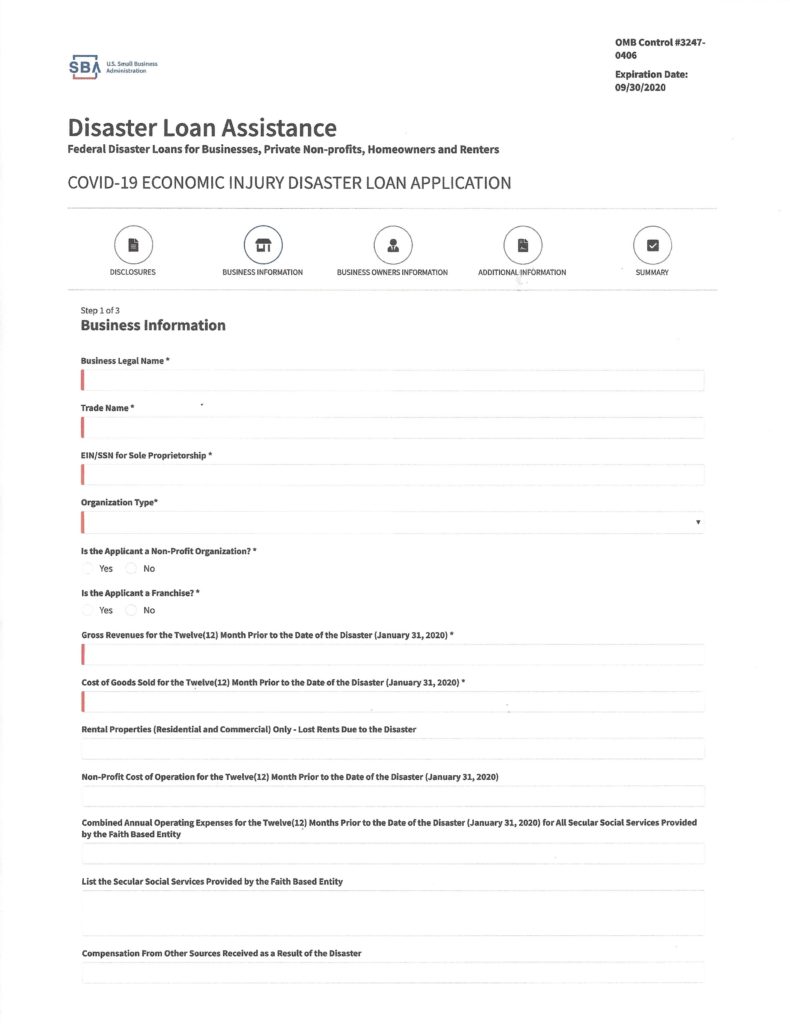

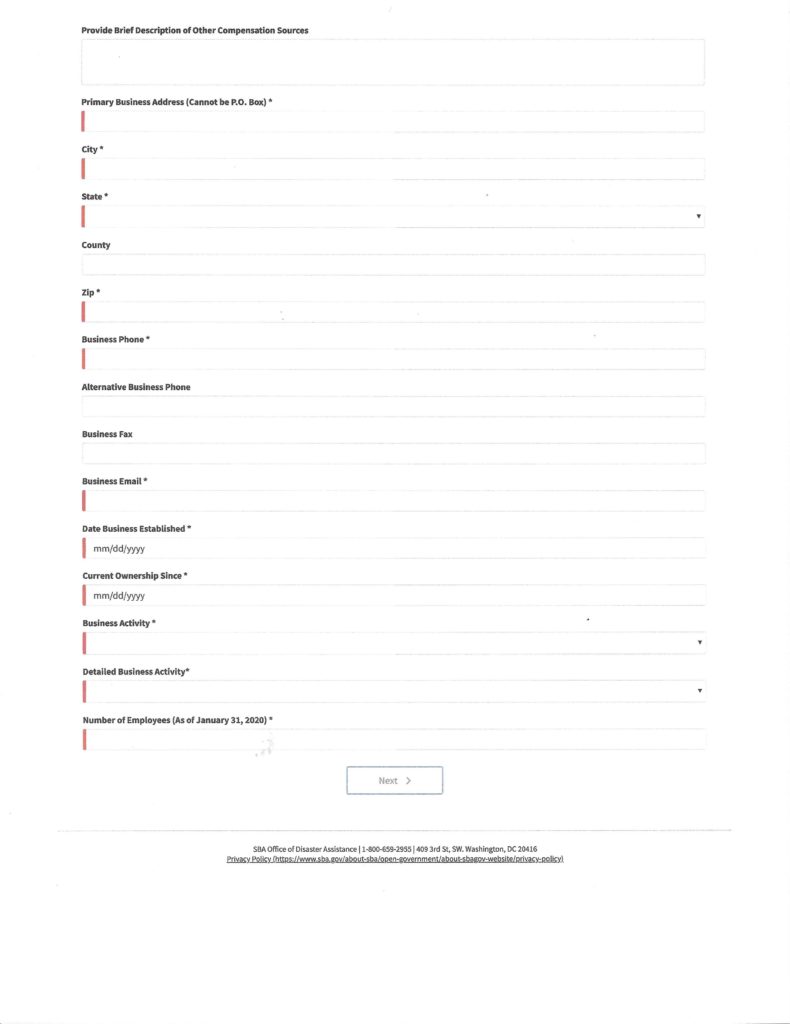

Below is an example of the information they will ask, so make sure you have this information: